Summary

- In cutting the Official Cash Rate (OCR) by 0.25% to 5.25% the Reserve Bank of New Zealand (RBNZ) Monetary Policy Committee (MPC) has executed a 180 degree turn from its hawkish stance just three months ago.

- The deciding factor for the MPC’s OCR cut was its view that excess capacity is growing by more than expected, which is seen as pushing inflation down further than it previously thought.

- We consider the RBNZ will need to follow up with OCR cuts in subsequent meetings to stabilise the New Zealand economy and put a lid on rising job losses.

From pivot to turnaround

The Reserve Bank of New Zealand (RBNZ) Monetary Policy Committee (MPC) has finally succumbed to the anaemic state of the New Zealand economy and clear evidence the RBNZ’s inflation target will soon be achieved by cutting the Official Cash Rate (OCR) 0.25% to 5.25%. This is the first OCR cut since March 2020.

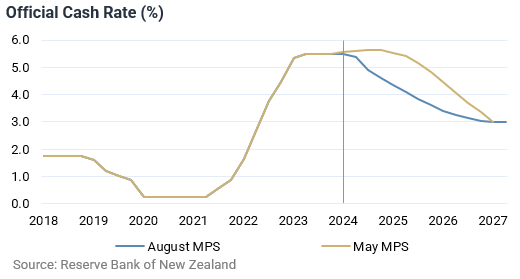

In addition, the RBNZ forecasts just over 0.5% of OCR cuts this year and a further 1.0% of cuts in 2025. This is a stark contrast to its decision and predictions in May when it maintained a cautious outlook on inflation and predicted the OCR would need to be maintained at its current level until the third quarter of 2025. In fact, at the May meeting, the RBNZ Governor Adrian Orr disclosed the MPC considered an OCR hike.

While the MPC softened its view somewhat at its July meeting, recognising emerging economic weakness and more satisfactory progress towards the RBNZ’s inflation target, it reiterated the need for restrictive monetary policy for a considerable period.

Since the May MPC meeting, the economy has largely evolved in-line with the RBNZ’s May forecasts. We thought, with this background, the MPC would possibly find it too much of a leap to begin cutting the OCR around a year earlier than previously indicated.

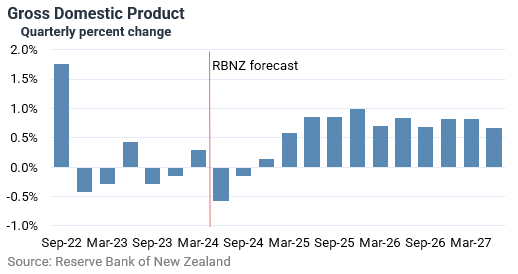

In the end, the RBNZ sees a significantly weaker domestic economy than previously, with a triple-dip recession evolving in the June and September quarters this year. This view has been informed by recent timely indicators such as electronic card transactions, business surveys, vehicle traffic, house sales, job advertising, and partial employment indicators.

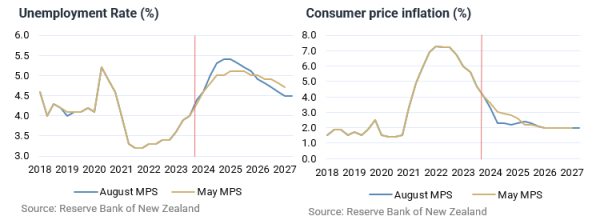

A weaker starting point for the economy compared to last time and recent signs of continuing economic weakness has convinced the MPC excess capacity is growing, with the unemployment rate peaking at 5.4%, which is significantly higher than the 5.1% peak expected by the RBNZ in May. This is seen as pushing inflation down further than it previously thought.

Given the RBNZ’s revised forecasts, the MPC is concerned about avoiding unnecessary near-term instability in the economy and employment given the signs of economic weakness.

Further easing is needed soon

It is heartening the MPC has recognised the parlous state of the New Zealand economy and that an ultra-cautious stance on inflation is no longer warranted. In flipping around its view, the MPC has taken an encouraging step towards a more forward-looking approach to setting monetary policy.

We consider inflation pressures are likely to further abate as global inflation fades and our labour market continues to weaken. Monetary policy is now only marginally less restrictive than it was previously. Therefore, we consider the RBNZ will need to follow up with OCR cuts in subsequent meetings to stabilise the New Zealand economy and put a lid on rising job losses.

We expect the MPC will cut the OCR by 0.25% in both its October and November meetings and there will be around 1.25% of OCR cuts over the next twelve months, resulting in an OCR of 4.0%.

John Carran is Director, Investment Strategist and Economist, Wealth Research. The information and commentary in this article are provided for general information purposes only. It reflects views and research available at the time of publication, using external sources, systems and other data and information we believe to be accurate, complete and reliable at the time of preparation. We make no representation or warranty as to the accuracy, correctness and completeness of that information, and will not be liable or responsible for any error or omission. It is not to be relied upon as a basis for making any investment decision. Please seek specific investment advice before making any investment decision or taking any action. Jarden Wealth Limited is an NZX Advisory Firm. A financial advice provider disclosure statement is available free of charge here.