Challenging but unsurprising

Summary

There were no major surprises in the Budget, with tax relief the centrepiece. Health, education, law and order and transport also were allocated significant extra funding.

While the Budget initiatives were largely fiscally neutral, a weaker economic outlook means the return to budget surplus is further delayed until 2027/28.

Given the tight room for future Budget initiatives and downside risks to the New Zealand economy, the years ahead will be challenging for the Government.

As promised

There were no major surprises unveiled in the Government’s Budget announced today, with tax relief and extra funding for health, education, law and order, social services, and transport offset by fiscal savings in other areas.

Tax relief

Tax relief was the centrepiece of the Budget, largely in line with what was promised by the National Party in the 2023 Election. The total cost of tax relief is estimated at $3.7 billion per annum on average over the next four years.

Increases in personal income tax thresholds results in tax relief for all people earning over $14,000 per annum from 31 July 2024. Changes to the independent earner tax credit and the in-work tax credit and a payment to help with costs of early childhood education also formed part of the Budget tax package.

Health and education

Total extra health funding for capital and operating spending is $8.2 billion per annum over the next four years. The big areas of extra spending in health include funding for hospital and specialty services and primary care and public health.

Education gets an extra $2.9 billion per annum over the next four years, with $1.5 billion allocated to building new schools and classrooms and upgrades of existing facilities. Extension of the Healthy Lunch Programme and other assistance for early childhood education were also announced.

Law and order

Money for extra prisons, prison officers, and frontline policing were announced. Extra operating and capital funding in these areas totals $2.9 billion over the next four years.

Treasury economic and fiscal outlook

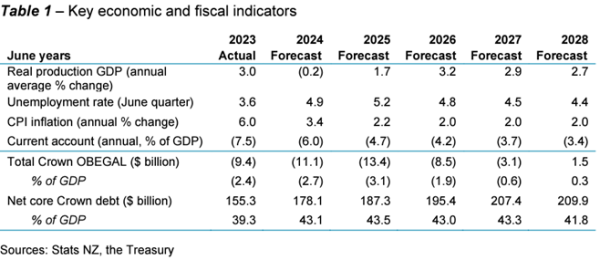

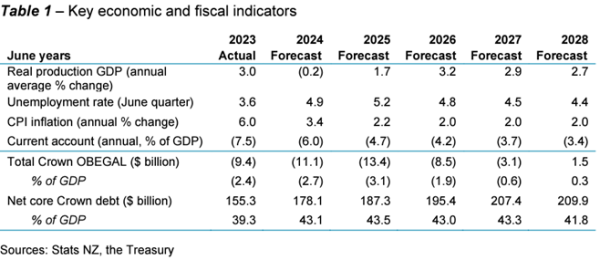

The Treasury forecast a weaker New Zealand economy than its last set of forecasts in December 2023. The Treasury expect the economy to contract 0.4% in the year to June before recovering due to the boost from the Budget tax package, a continuing recovery in tourism earnings and an easing in inflation, which allows a gradual reduction in interest rates. The unemployment rate is predicted to peak at 5.3% at the end of 2024.

While the new policy initiatives and savings announced in the Budget are largely fiscally neutral, a weaker economy causes the fiscal outlook to look worse than previously estimated in the Half Year Economic and Fiscal Update. A slim budget surplus is achieved in 2027/28 compared to 2026/27 predicted earlier. Net debt as a share of gross domestic product (GDP), peaks at 43.5% in 2024/25 and then declines to 41.8% of GDP at the end of the forecast period, which is above the Government’s 40% of GDP net debt target.

As a result of higher deficits, the New Zealand Debt Management Office (NZDMO) estimate it will have to issue an extra $12 billion of debt over the next four years compared to what it previously expected.

Comment

The Government’s Budget was largely as expected and does not have significant implications for the economic outlook. However, the pushing out of the return to budget surplus presents some vulnerability to New Zealand’s credit rating should there be further slippage. Given the tight room for future Budget initiatives and downside risks to the New Zealand economy, the years ahead will be challenging for the Government

John Carran is Director, Investment Strategist and Economist, Wealth Research. The information and commentary in this article are provided for general information purposes only. It reflects views and research available at the time of publication, using external sources, systems and other data and information we believe to be accurate, complete and reliable at the time of preparation. We make no representation or warranty as to the accuracy, correctness and completeness of that information, and will not be liable or responsible for any error or omission. It is not to be relied upon as a basis for making any investment decision. Please seek specific investment advice before making any investment decision or taking any action. Jarden Wealth Limited is an NZX Advisory Firm. A financial advice provider disclosure statement is available free of charge here.