Disinflation on track

Summary

- Disinflation progress continued to be made in the June quarter, with the annual inflation rate just a touch above the Reserve Bank’s 1-3% target.

- Despite non-tradeable inflation remaining sticky, the Reserve Bank is likely to see justification in the June quarter outcome for its recent pivot to a less aggressive stance.

- OCR cuts are coming soon, with the timing of the first cut likely dependent on evidence on the state of the labour market in the June quarter.

Inflation close to Reserve Bank target

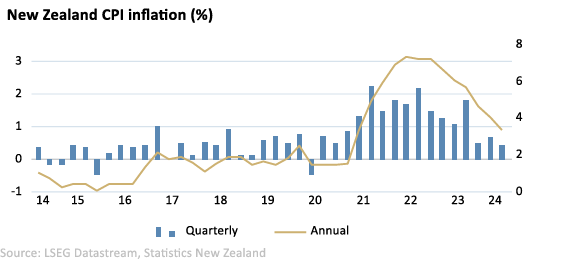

June quarter Consumer Price Index (CPI) inflation came in at 0.4% on a quarterly basis and 3.3% on an annual basis, which continues the disinflation trend apparent since the end of 2022.

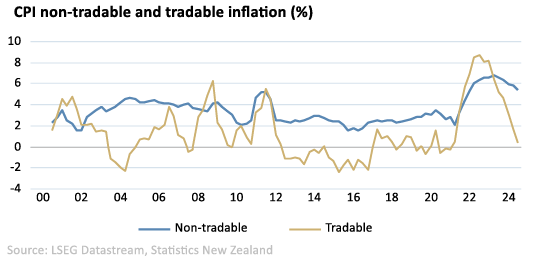

The main downward pressure on inflation has been in tradeable prices, which have declined over the past three quarters. Annual tradeable inflation is now running at only 0.3%.

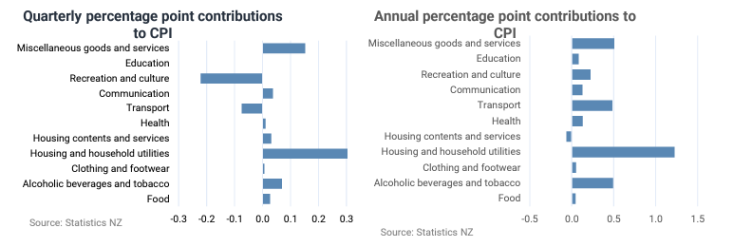

Non-tradeable inflation has been coming down gradually but, at 5.4%, remains elevated compared to history. It is being materially held up by increases in rents, insurance premiums and property rates.

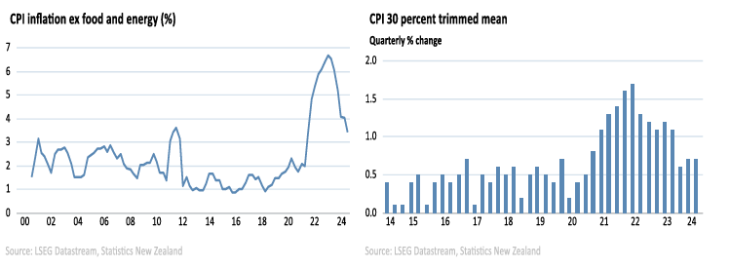

Measures of underlying inflation also declined and are now running at annual rates in the range of 3.4% to 3.8%. However, the quarterly rate of trimmed mean inflation ticked up marginally in the June quarter from the March quarter, which provides a little less comfort in disinflation progress than the fall in annual inflation suggests.

Sticky non-tradeable inflation

June quarter inflation came in below the 0.6% quarterly rate the Reserve Bank expected in its May Monetary Policy Statement (MPS). With the annual inflation rate now at 3.3% it is within touching distance of the Reserve Bank’s 1-3% target. Non-tradeable inflation remains relatively sticky however and is slightly above where the Reserve Bank predicted it would be in its May MPS.

It has become increasingly apparent non-tradeable inflation is being materially held up by price rises in areas that are insensitive to the Reserve Bank’s actions, such as property rates, insurance premiums, and alcohol and tobacco. In addition, rent increases have been driven by a high population growth rate due to strong net inward migration. In these regards, price rises are reflective of relative price changes and not part of a general inflation dynamic.

Reserve Bank still on track for OCR cuts soon

Therefore, given considerable disinflation progress and alongside signs of weakness in the domestic economy, increasing unemployment, and easing inflation expectations we consider the June quarter inflation result gives justification for the Reserve Bank’s recent pivot to a less aggressive monetary policy stance.

We consider the most likely timing for the first Reserve Bank OCR cut this cycle will be in November. However, if June quarter labour market statistics show a weaker outcome than the Reserve Bank expected in its May MPS, we would expect the first OCR cut in October, with at least 0.5% of cuts by the end of the year.

John Carran is Director, Investment Strategist and Economist, Wealth Research. The information and commentary in this article are provided for general information purposes only. It reflects views and research available at the time of publication, using external sources, systems and other data and information we believe to be accurate, complete and reliable at the time of preparation. We make no representation or warranty as to the accuracy, correctness and completeness of that information, and will not be liable or responsible for any error or omission. It is not to be relied upon as a basis for making any investment decision. Please seek specific investment advice before making any investment decision or taking any action. Jarden Wealth Limited is an NZX Advisory Firm. A financial advice provider disclosure statement is available free of charge here.