Loosening conditions

Summary

- The labour market showed a clear cooling trend in the March quarter. We expect further labour market softness ahead.

- The Reserve Bank of New Zealand (RBNZ) Monetary Policy Committee (MPC) is unlikely at this stage to be overly swayed to an easier stance by the labour market trend.

- However, a step down in June quarter consumer price inflation could persuade the MPC to start cutting the Official Cash Rate (OCR) at the RBNZ’s November meeting.

Cooling trend

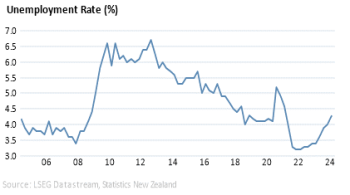

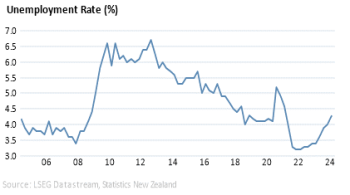

Labour market conditions clearly eased in the March quarter. The unemployment rate ticked up further to 4.3%, continuing the upward trend of the past year and a half. A marked rise in the underutilisation rate, which includes the unemployed and people in jobs who would work more hours if they had the opportunity, suggests significant underlying labour market weakening.

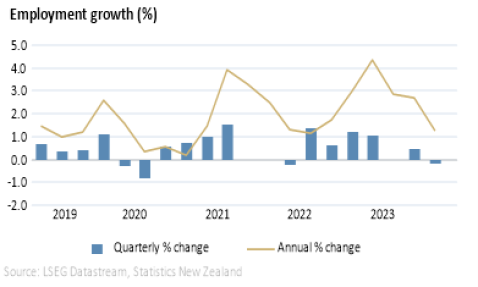

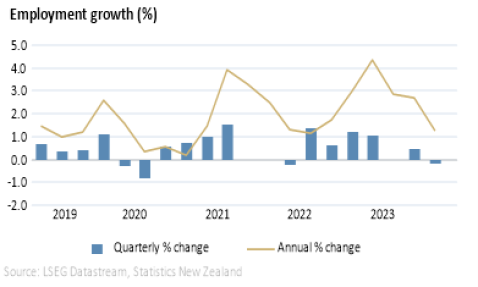

A 0.2% decline in employment over the quarter shows that unemployment is reflective of continuing weakness in the domestic economy after the recession at the end of 2023. Unemployment is now clearly being driven by job shedding as well as an expanding pool of people looking for jobs.

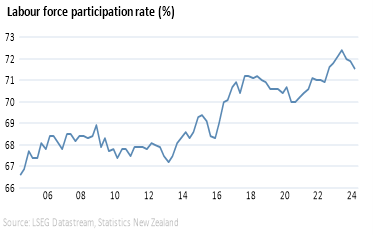

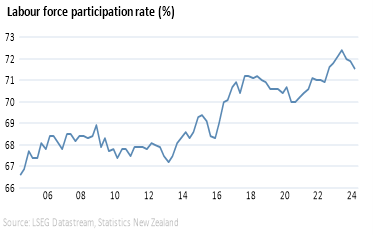

A fall in labour force participation rate suggests labour market cooling is discouraging some workers from looking for a job. A slowdown in labour force growth in the March quarter from its recent robust rate helped moderate the rise in the unemployment rate.

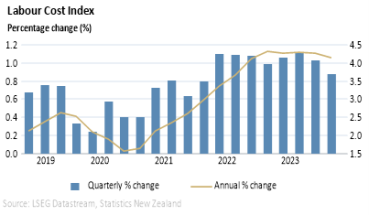

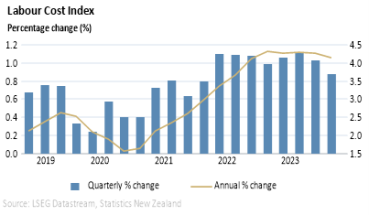

Wage growth also materially eased, with private sector average hourly earnings growth falling sharply to an annual rate of 4.8% in the March quarter from 6.6% in the December quarter. While wage growth is still too high to be consistent with low and stable inflation, it has been convincingly trending down over the past year and a half. This is likely to take pressure off domestic services inflation, which has recently proven to be somewhat sticky.

We expect the labour market will continue to weaken this year as a tepid New Zealand economy causes businesses to shed more workers and moderate their pay rises. This will likely further gradually dampen services inflation.

OCR cuts likely later this year

The labour market has softened largely in line with what the RBNZ expected in its February Monetary Policy Statement. Therefore, the March quarter labour market outcome on its own is unlikely to sway the RBNZ to an easier stance.

June quarter Consumer Price Index (CPI) inflation, released on 17 July, will be critical to the RBNZ’s future moves. With clear signs of labour market cooling, a significant step down in CPI inflation could persuade the RBNZ to signal the beginning of OCR cuts in the fourth quarter of this year.

John Carran is an Investment Strategist and Economist at Jarden. The information and commentary in this article are provided for general information purposes only. It reflects views and research available at the time of publication, using external sources, systems and other data and information we believe to be accurate, complete and reliable at the time of preparation. We make no representation or warranty as to the accuracy, correctness and completeness of that information, and will not be liable or responsible for any error or omission. It is not to be relied upon as a basis for making any investment decision. Please seek specific investment advice before making any investment decision or taking any action. Jarden Securities Limited is an NZX Firm. A financial advice provider disclosure statement is available free of charge here.