Double-Dipping

Summary

- With a mild contraction in the September and December quarters, the New Zealand economy entered a double-dip recession.

- Goods producing sectors, transport, wholesale, and retail activities suffered the most in the December quarter, while business and government services performed well.

- While economic activity was undoubtedly tepid in the December quarter, a large decline in business inventories overstated overall softness. On the positive side, household consumption help up reasonably well and exports surged.

- The latest economic data will likely give the Reserve Bank some comfort that its more balanced view on inflation and economic risks at its February meeting was justified.

Into the red …again

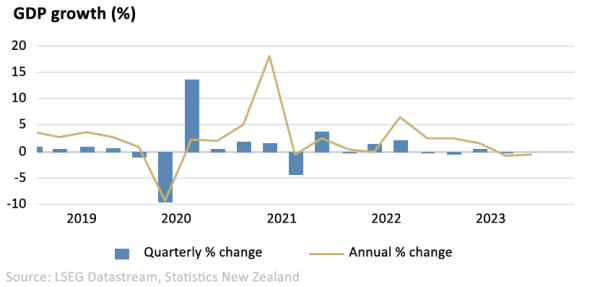

With a -0.1% contraction in December 2023 quarter Gross Domestic Product (GDP), following a -0.3% contraction in the September quarter, New Zealand’s economy entered a double-dip recession. This is after experiencing consecutive quarters of negative growth in December 2022 and March 2023. On an annual basis, GDP growth was an anaemic -0.5%.

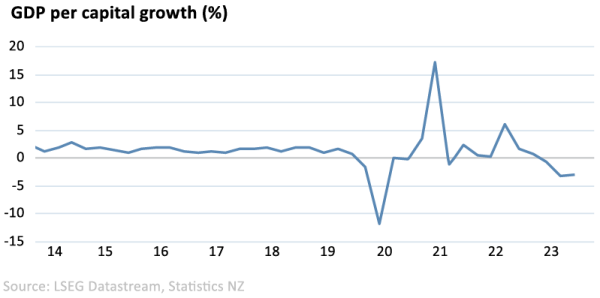

Per capita economic growth, at -3.1% on an annual basis, was very weak, suggesting the recent surge in net inward migration has helped prevent plunging economic activity.

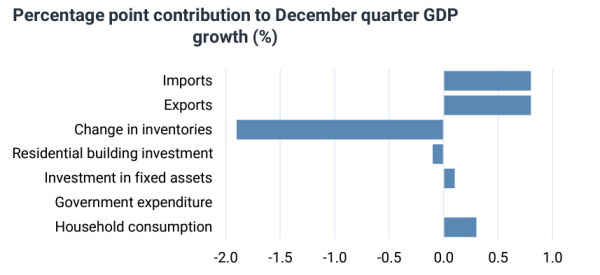

The largest negative contributor to economic weakness in the quarter was a substantial run down in business inventories. This suggests overall economic weakness in the December quarter is overstated somewhat. Subsequent business restocking over coming quarters may have a positive effect on economic activity.

More positively, activity in the rest of the economy was reasonable, with moderate consumption growth and a surge in exports. A decline in imports also made a positive contribution to growth over the December quarter.

On an industry basis, goods producers, wholesale, transportation, and retail were the weakest parts of the economy in the December quarter. This is consistent with domestic consumers switching their spending away from goods purchases towards services. Areas related to business and government services were positive contributors to economic growth.

Giving the Reserve Bank comfort

While undoubtedly soft, overall economic activity may not be in as bad shape as the headline GDP numbers suggest. Recent indicators suggest activity may be improving to a degree, with early spending and employment numbers holding up reasonably well. The latest economic data will likely give the Reserve Bank some comfort its more balanced view on inflation and economic risks at its February meeting was justified. They will likely continue to take a cautious approach to future Official Cash Rate cuts.

John Carran is an Investment Strategist and Economist and John Norling is Director, Head of Wealth Research at Jarden. The information and commentary in this article are provided for general information purposes only. It reflects views and research available at the time of publication, using external sources, systems and other data and information we believe to be accurate, complete and reliable at the time of preparation. We make no representation or warranty as to the accuracy, correctness and completeness of that information, and will not be liable or responsible for any error or omission. It is not to be relied upon as a basis for making any investment decision. Please seek specific investment advice before making any investment decision or taking any action. Jarden Securities Limited is an NZX Firm. A financial advice provider disclosure statement is available free of charge here.