Summary

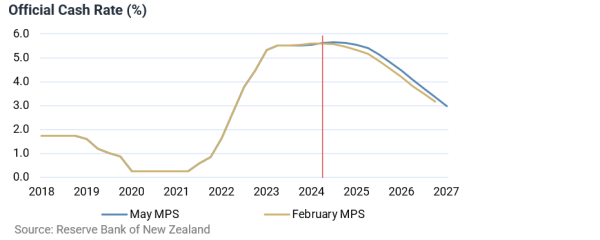

The Reserve Bank Monetary Policy Committee kept the Official Cash Rate (OCR) at 5.5% as most expected.

The Committee ignored clear signs of weakening in the New Zealand economy and labour market and maintained a stringent OCR outlook, with cuts not occurring until at least the September quarter 2025.

We continue to see a weakening economy and gradually ebbing inflation allowing the Reserve Bank to cut the Official Cash Rate in the December quarter this year.

Ignoring the weakness

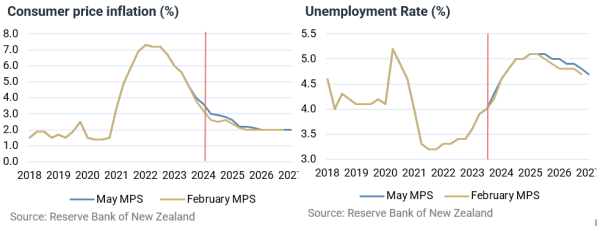

The Reserve Bank of New Zealand (RBNZ) continues to signal caution on the progress of inflation despite clear signs of economic weakness, and its expectation of lower economic growth and higher unemployment ahead.

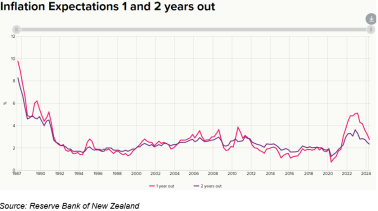

The main concern of the RBNZ is that the stickier parts of inflation, such as rents, residential rates, and insurance may lead to higher inflation expectations for longer. The RBNZ considers these factors may ultimately make keeping inflation within the RBNZ’s 1-3% target range harder.

This concern has led the RBNZ to slightly raise its forecast for near-term inflation and marginally raising the path of the Official Cash Rate (OCR) in 2025 and beyond compared to its February forecast.

The RBNZ appears overly concerned with parts of inflation that are naturally lagging and mostly beyond the control of monetary policy. The RBNZ’s continued hawkish stance also appears inconsistent with the material recent decline in near-term inflation expectations and well-anchored longer-term inflation expectations at just over 2% according to the RBNZ’s own survey of professional forecasters.

The conclusion may be drawn that the RBNZ’s hawkish stance in this announcement is primarily to push back against financial market expectations that OCR cuts may begin as early as July this year, with nearly two OCR cuts priced by the end of the year.

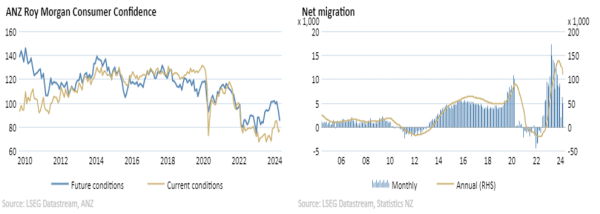

The New Zealand economy is not in a good place currently, with reticent consumers, rising unemployment, plummeting residential building activity, and softening export markets. In addition, the rate of net migration inflows is easing, which will reduce one recent positive impetus for New Zealand economy. Inflation pressures are easing, and services inflation will likely eventually come down in line with a weak local economy and softening labour market.

We continue to see the RBNZ’s November meeting as the most likely timing for an OCR cut. A cut in October is also an outside chance in our view.

John Carran is Director, Investment Strategist and Economist, Wealth Research. The information and commentary in this article are provided for general information purposes only. It reflects views and research available at the time of publication, using external sources, systems and other data and information we believe to be accurate, complete and reliable at the time of preparation. We make no representation or warranty as to the accuracy, correctness and completeness of that information, and will not be liable or responsible for any error or omission. It is not to be relied upon as a basis for making any investment decision. Please seek specific investment advice before making any investment decision or taking any action. Jarden Wealth Limited is an NZX Advisory Firm. A financial advice provider disclosure statement is available free of charge here.