Summary

- Economic activity bounced modestly in the March quarter 2024 after a weak end to 2023.

- Consumers appear to be in slightly better shape than many thought, although measurement difficulties suggest there should be caution in coming to firm conclusions at this stage.

- The March quarter GDP result is unlikely to change the Reserve Bank’s thinking on inflation pressures and the future path of the Official Cash Rate.

- We expect further declines in inflation and continuing weak economic growth in the near-term will give scope for the Reserve Bank to begin cutting the Official Cash rate at its November meeting.

An anaemic bounce

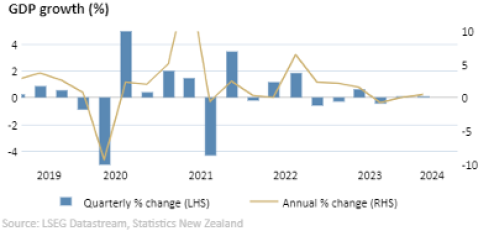

Economic activity in the March quarter regained some of the ground lost in the previous two quarters, with Gross Domestic Product (GDP) increasing 0.2% in the quarter. However, the economic growth trend is tepid, with GDP only up 0.2% on an annual basis.

Without recent strong population growth economic growth would have been significantly weaker. This is highlighted by annual per capita GDP falling 2.4%.

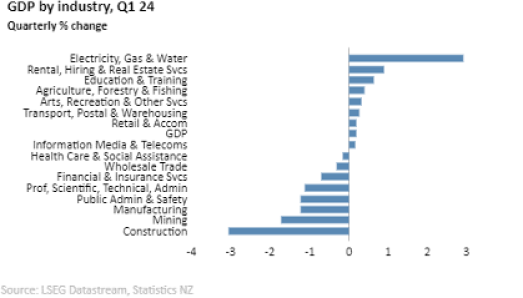

By industry, primary industries and many services industries were positive contributors to the moderate lift in overall activity. Goods producing industries like construction and manufacturing were very weak in the quarter.

On an expenditure basis, household consumption was the most significant positive contributor to overall economic activity in the March quarter, rising a solid 1.6%. Changes in government expenditure, business investment, exports and imports detracted from quarterly economic performance.

An interesting aspect of the household consumption increase was that there was strong growth in direct imports by consumers due to online purchases. This is likely one factor explaining the weakness on domestic retail trade in recent times.

Statistics New Zealand highlights substantial difficulties with measurement of household expenditure and net services exports related to changing seasonal tourism patterns post-pandemic. Therefore, there is a high degree of uncertainty about quarterly changes in these areas and overall GDP changes.

Not enough information for the RBNZ to change its mind

The March quarter GDP result was in line with the most recent forecasts of the Reserve Bank of New Zealand (RBNZ). However, it will have difficulty separating the signal from the noise from the details of the result given measurement uncertainties.

It is unlikely the RBNZ’s cautious outlook on inflation and expectation that the Official Cash Rate (OCR) will remain at its current level for an extended period will change based on the March quarter GDP result.

The June quarter Consumer Price Index (CPI) and labour market statistics released in July stand to be the critical deciders of whether the RBNZ brings forward its first OCR cut from late 2025 as currently expected.

We expect that both CPI inflation and labour market will be weaker than the RBNZ had expected in its May economic forecasts. This, together with signs of continuing weakness in the New Zealand economy, is likely to persuade the RBNZ to cut the OCR by 0.25% at its November meeting. Subsequently, we expect the RBNZ will cut the OCR by at least 1.25% in 2025.

John Carran is Director, Investment Strategist and Economist, Wealth Research. The information and commentary in this article are provided for general information purposes only. It reflects views and research available at the time of publication, using external sources, systems and other data and information we believe to be accurate, complete and reliable at the time of preparation. We make no representation or warranty as to the accuracy, correctness and completeness of that information, and will not be liable or responsible for any error or omission. It is not to be relied upon as a basis for making any investment decision. Please seek specific investment advice before making any investment decision or taking any action. Jarden Wealth Limited is an NZX Advisory Firm. A financial advice provider disclosure statement is available free of charge here.